Figuring depreciation on rental property

Rental income is money you receive for the. Occupancy of real estate.

Rental Property Depreciation Calculator On Sale 56 Off Www Ingeniovirtual Com

Lets consider the above example for this cost basis of.

. If your taxable income is 496600 or more the capital gains rate increases to 20. The result is 126000. Under these conditions youll be allowed to deduct.

Depreciation expense Actual value of the property divided by 275 years. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. For tax purposes you can only claim depreciation for investment properties eg.

Home owners are not allowed to include depreciation as property expenses. If that is the case the basis for depreciation is the lesser of either its adjusted basis or its fair market value at the time the property was placed in service for rental. To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years.

Use of personal property. Now you need to divide the cost basis by the propertys useful life to calculate the annual depreciation on a property. Amounts received from tenants for the monthly rent of property.

For residential property the federal depreciation period is 275 years. A straight-line depreciation method helps the owner determine the depreciation on the rental property. This means that you deduct 1275 of the purchase price of the building onlynot the landevery year.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. To calculate your depreciation expense heres the formula. When you sell your home that you have lived in and owned for more than two years within the last five years you get to exclude.

Discover The Answers You Need Here. The building is depreciable over 275 years. Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses.

For a married couple filing jointly with a taxable income of 280000 and capital gains of. 325000 275 1181818 Therefore the depreciation is 1181818. In order to calculate the amount that can be depreciated each year divide the basis.

How To Calculate Depreciation On A Rental Property The rental property depreciation process has four basic steps that include determining the cost basis of your. To find out the basis of the rental just calculate 90 of 140000. As for the residence itself the IRS requires.

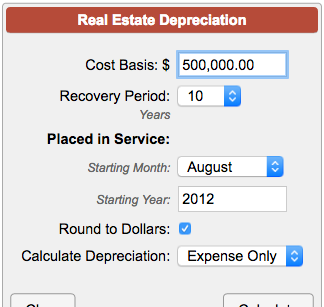

How to Calculate Depreciation by Month A real estate investor can claim.

What You Need To Know About Rental Property Depreciation

Rental Property Depreciation Rules Schedule Recapture

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Rental Property Depreciation Calculator Discount 59 Off Www Ingeniovirtual Com

Rental Property Depreciation Calculator Cheap Sale 60 Off Www Barribarcelona Com

How To Calculate Depreciation On A Rental Property

Real Estate Tax Depreciation How It Works Grant Wydeven

Depreciation For Rental Property How To Calculate

Depreciation For Rental Property How To Calculate

Rental Property Depreciation Calculator Flash Sales 53 Off Www Ingeniovirtual Com

How Rental Property Depreciation Works The Benefits To You

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

How To Calculate Depreciation On Rental Property

Straight Line Depreciation Calculator And Definition Retipster

Rental Property Depreciation Rules Schedule Recapture

Macrs Depreciation Calculator With Formula Nerd Counter